Find It Locally

Search CISA’s online guide to local farms, food, and more!

Find Local FoodFinancial statements allow you or your bookkeeper to analyze and understand your business. Financial statements:

Effective management of your farm business finances will involve several different types of tracking. It’s easiest to understand the value of each form in terms of the primary question that it answers.

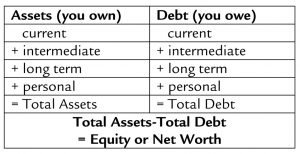

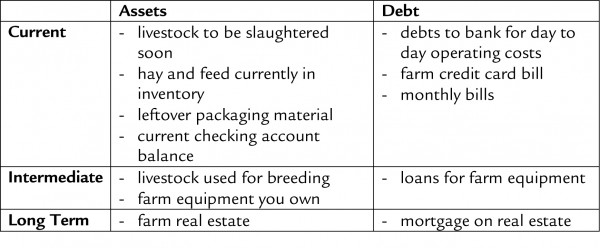

A balance sheet tracks your current, intermediate, and long-term assets and liabilities (or debt). Their purpose is to show your net worth, which is a snapshot that captures what you own minus what you owe, at any given moment in time.

Below is an extremely simplified depiction of what a balance sheet tracks:

Some examples of what would be considered current, intermediate, and long-term assets:

Cash Flow statements track expected cash expenses and income by category for a set period of time and can help you keep track of your liquidity and future cash needs.

Cash Flow statements do not calculate profit or include non-cash assets or debts outside of payments owed during the time period you are tracking. They are one of the few financial statements that usually include both your business and personal finances.

Below is an extremely simplified version of what the Cash Flow statement includes and examples of what would fit into each category:

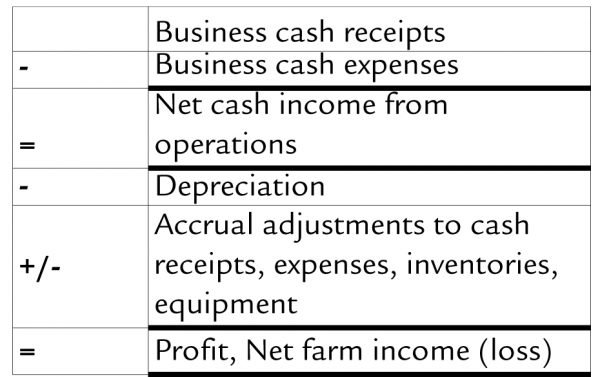

Also known as an income statement, the Profit and Loss statement measures your sales, expenses, depreciation, and profit. It tracks how revenue is transformed into net income over a set time period, usually a year.

The basic formula of the Profit and Loss statement:

Unlike the Cash Flow statement, on the Profit and Loss:

Unlike the Balance Sheet, the Profit and Loss is in constant flux and should be tracked in an ongoing way. Alternatively, the Balance Sheet is a snapshot that acts as a monthly checkpoint.

There are several simple ratios you can use to measure your farm’s financial health.

Solvency: debt-to-asset ratio

Liquidity: current ratio

Profitability: return on assets

Accuracy is important. Data entered into the statement is just as important as the system itself.

Accrual: Accounts on a balance sheet that represent liabilities and non-cash-based assets used in accrual-based accounting. These accounts include, among many others, accounts payable, accounts receivable, goodwill, future tax liability, and future interest and expense.

Assets: A resources with economic value that an individual, corporation or country owns or controls with the expectation that it will provide future benefit.

Debt: An amount of money borrowed by one party from another. A debt arrangement gives the borrowing party permission to borrow money under the condition that it is to be paid back at a later date, usually with interest.

Equity: In finance, in general, you can think of equity as ownership of any asset after all debts associated with that asset are paid off.

Liabilities: A company’s legal debts or obligations that arise during the course of business operations. Liabilities include loads, accounts payable, mortgages, deferred revenues and accrued expenses.

Liquidity: The degree to which an asset can be bought or sold in the market without affecting the asset’s price. The ability to convert an asset to cash quickly.

Net Income: A company’s total earnings (or profit). Net income is calculated by taking revenues and adjusting for the cost of doing business, depreciation, interest, taxes, and other expenses.

Net Worth: The amount by which assets exceed liabilities.

Profit: A financial benefit that is realized when the amount of revenue gained from a business activity exceeds the expenses, costs and taxes needed to sustain the activity.

Revenue: The amount of money that a company actually receives during a specific period. It is the “top line” or “gross income” figure from which costs are subtracted to determine net income.

*All definitions from investopedia.com.

This material is based upon work supported by USDA/NIFA under Award Number 2010-49200-06201.